How to Calculate Your Paycheck in Arkansas

Table of Content

An easy, time-saving payroll solution for your small business. While it might sound good to get a large return, remember that if you had access to that money throughout the year, you could have put it toward something else, like a down payment or your retirement savings. By overpaying the IRS all year, you’re essentially giving them an interest-free loan. If you’re a new employer (congratulations on getting started!), you pay a flat rate of 3.1% (this is including a 0.3% stabilization tax). Hourly individuals must enter their hourly rate and number of straight time, time and 1/2 and double time hours. The IRS has changed the withholding rules effective January 2020.

In the case of employees, they pay half of it, and their employer pays the other half. Independent contractors or self-employed individuals pay the full amount because they are both employees and employers. This is one of the reasons why independent contractors tend to be paid more hourly than regular employees for the same job. Another way of reducing your taxable income is to put money into pre-tax accounts, like a health savings account or flexible spending account. Just be aware that the money you put in one of these accounts may not roll over. Money does roll over in an HSA but only $500 in an FSA will roll over.

Arkansas Gross-Up Calculator

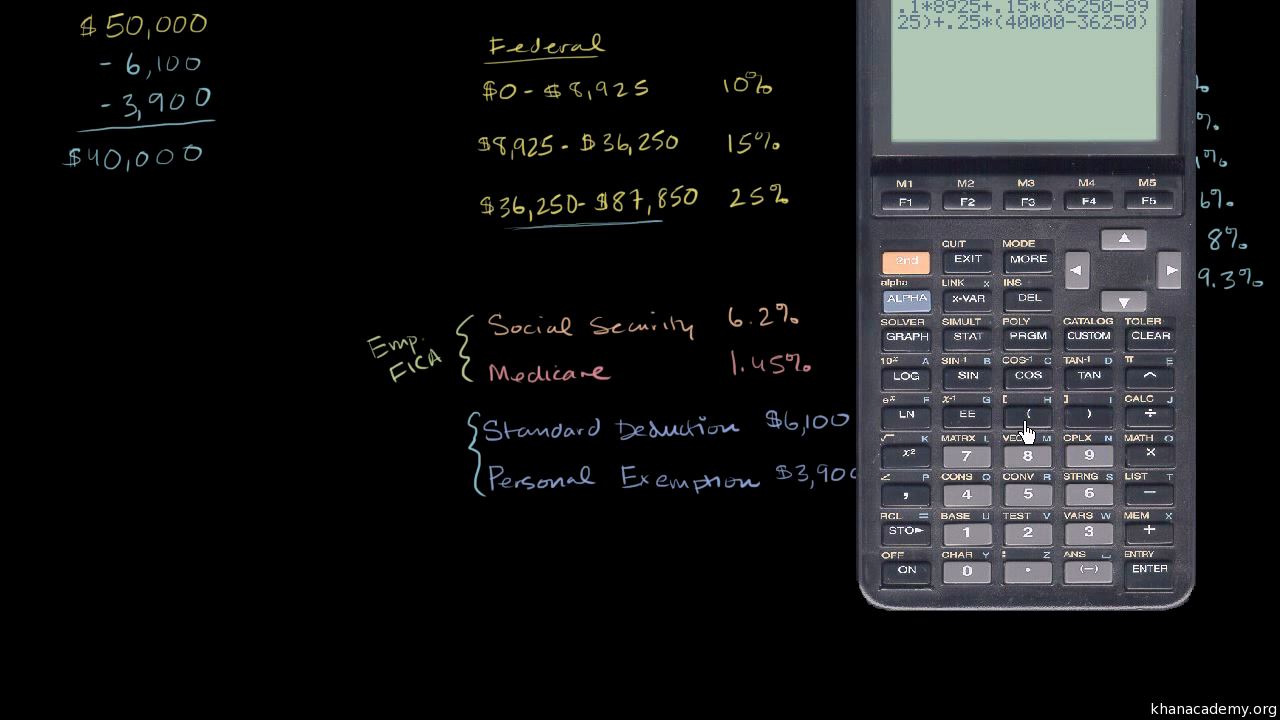

Medicare is meant to supplement an employee’s healthcare benefits when they reach retirement age. Both employers and employees are required to contribute to Medicare at a rate of 1.45%. For employees, there is an additional 0.9% Medicare tax on wages earned after a $200,000 threshold.

First, we calculate your adjusted gross income by taking your total household income and reducing it by certain items such as contributions to your 401. If a state has zero income tax, this usually means they find creative ways to tax you in other ways in order to compensate. For example, this could potentially be through higher property taxes, higher sales taxes, fewer state services, fewer state benefits, etc. Obviously, each state will be different and this may not be the case in every state.

Arkansas Income Tax Brackets and Other Information

Exemptions can be claimed for each taxpayer as well as dependents such as one’s spouse or children. Arkansas taxpayers pay some of the highest sales tax rates in the country, while also having some of the lowest property tax rates. Please keep in mind that these calculators are designed to provide general guidance and estimations. They are not official advice and do not represent any Netchex service. Please consult an accountant or invest in full-servicepayroll softwareto guarantee quick, automatic, and accurate payroll and tax services.

The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially. When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52. That’s because your employer withholds taxes from each paycheck, lowering your overall pay.

Self-service payroll for your small business.

The state income tax system in Arkansas has 3 to 6 different tax brackets depending on the level of your income and what category it falls into. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. Employees can log into to verify their wages and confirm their benefits at various retirement ages. To understand your paycheck better and learn what are FIT, SUI, SDI, FLI, WC, and other taxes, check the payroll results FAQs below the results.

If you make contributions to a retirement plan like a 401 or a health savings account , that money will also come out of your paycheck. However, those contributions come out of your paycheck prior to taxes, so they lower your taxable income and save you money. The aggregate method is used if your bonus is on the same check as your regular paycheck. Your employer will withhold tax from your bonus plus your regular earnings according to your W-4 answers. Your bonus will be taxed the same as your regular pay, including income taxes, Medicare, and Social Security.

Within this law, the IRS also made revisions to the Form W-4. The new W-4 also uses a five-step process that allows filers to enter personal information, claim dependents and indicate any additional income or jobs. Each of these updates primarily affect anyone who is starting a new job or adjusting their withholdings. Your employer figures out how much to withhold in taxes from each of your paychecks from the information you put in your W-4 form. For example, how many qualifying dependents you have and your filing status (single, head of household, etc.) affect your income tax bracket. The new W-4 no longer utilizes allowances, as it now requires you to input annual dollar amounts for things like non-wage income, income tax credits, itemized and other deductions and total annual taxable wages.

On the other hand, an annual income higher than $84,500 see tax rates that range from 2% to 5.5%. Enter your employment income into the paycheck calculator above to estimate how taxes in Arkansas, USA may affect your finances. The gross pay method refers to whether the gross pay is an annual amount or a per period amount.

There are three tax brackets with rates ranging from 2% on your first $4,700 up to a rate of 5.90% on income above $38,500. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. In the previous tax year, you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information.

Bi-weekly is once every other week with 26 payrolls per year. Get exclusive small business insights straight to your inbox. Discover a wealth of knowledge to help you tackle payroll, HR and benefits, and compliance. Focus on what matters most by outsourcing payroll and HR tasks, or join our PEO. This is not an offer to buy or sell any security or interest. Working with an adviser may come with potential downsides such as payment of fees .

Comments

Post a Comment